puerto rico tax incentives act 22

In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020. All non-residents who become residents of Puerto Rico are considered eligible under Act 22 unless he or she was a resident between January 16 1997.

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business

Chapter 2 Individuals Previously known as Act 22 Annual charitable donation.

. If youre a non-resident in Puerto Rico and interested in tax incentive-laden business opportunities looking closely at Puerto Rico Act 22 may be worth your while. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS Contact. 23 2023 along with step pay increases based on employees evaluations.

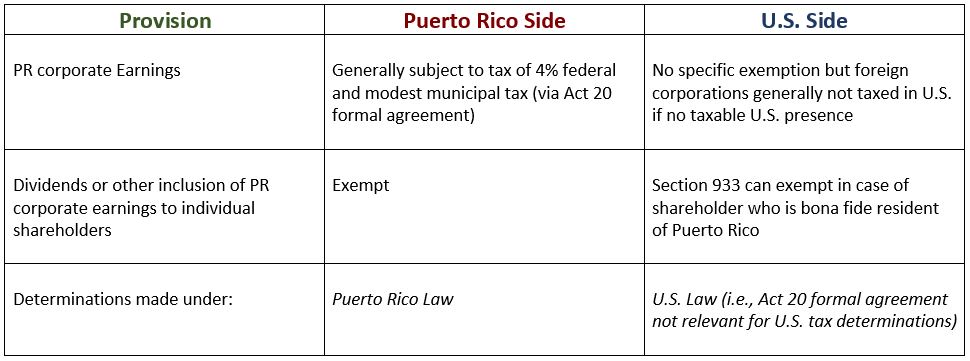

This explicitly includes capital gains earned. 75 property tax exemption for real property used in the Export Business taxable portion subject to regular tax rate of up 1183. 22 of 2012 as amended known as the Individual Investors Act the Act.

Puerto Rico Incentives Code 60 Updates from Act 22 Individuals The individual cannot have been a resident of Puerto Rico for at least 10 years prior this is increased from previously in which it was six years. The non-profit charitable contribution requirement which was previously at 5000 has been increased to 10000. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

To qualify the business cannot have any previous connections dealings or nexus with Puerto Rico. Under the new law grantees will need to make a 10000 annual charitable donation 5000 of that donation will go to a government-approved list of charities and 5000 may go to any Puerto Rican charity of your choice. By puertoricotaxincentives in Act 22 8 years ago 427 On January 17 2012 Puerto Rico enacted Act No.

For taxable year 2019 the Puerto Rico Treasury Department received 1044 returns from individuals who had the incentive. Under Act 22 bona fide residents of Puerto Rico who qualify can completely eliminate capital gains tax with a 100 tax exemption on assets acquired after the applicant has qualified. 100 income tax exemption for distributions from earnings and profits.

Along with Puerto Rico Tax Act 20 Puerto Rico adopted an additional incentive the Act to Promote the Relocation of Individual Investors Puerto Rico Tax Act 22 to stimulate economic development by offering nonresident individuals 100 tax exemptions on all interest all. Tax returns vs. The Act may have profound implications for the continued economic recovery of Puerto Rico.

Under this new law known as the Incentives Code Acts 20 and 22 have been consolidated into Act 60 and were subsequently renamed. Eligibility Who Qualifies. Make Puerto Rico Your New Home.

Fixed Income tax rate of 4. Both laws aim to provide attractive incentives to encourage investors to relocate to Puerto Rico while also. Act 22 - Puerto Rico Tax Incentives To Business Owners And Investors Puerto Rico Tax Act 22.

The DDEC had more than 2400 decrees in place then. The Act provides tax exemptions to eligible individuals residing in Puerto Rico. Since Act 22 was passed there are fewer tax returns filed at the Treasury Department from beneficiaries than decrees granted so far.

More importantly the requirements for each program have been adjusted. By 2 on July 22 2022 and another 2 on Jan. Act 20 and Act 22 were enacted in Puerto Rico in 2012 to promote the exportation of services by companies and individuals providing such services from Puerto Rico and the relocation of high-net-worth individuals to Puerto Rico.

3 hours agoWatson encouraged Council to approve two pay raises for city employees.

Centro De Periodismo Investigativo Puerto Rico Act 22 Tax Incentive Fails Centro De Periodismo Investigativo

Without Act 60 Investing In Puerto Rico Is Still Worth It Business Theweeklyjournal Com

Act 22 Individual Investors Puerto Rico Tax Incentives

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Guide To Income Tax In Puerto Rico

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Why People Are Moving To Puerto Rico In 2018 Act 20 Act 22 Youtube Puerto Rico Why People Acting

Big Shot Lawyers Lured By Beaches And 4 Tax Rate To Puerto Rico Wealth Management

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

Supreme Court Seems Divided Over Puerto Rico S Exclusion From Federal Benefits

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Previous To Moving To Puerto Rico Appreciation Loss Capital Gains Torres Cpa

Puerto Rico Workers Yes Colonizers No Workers World

Changes To Act 20 22 New Incentives Code Of Puerto Rico For Jan 1 2020 Relocate To Puerto Rico With Act 60 20 22

Tax Incentives Is Relocating To Puerto Rico The Right Move For You